网贷逾期36万怎么办理无力偿还的最后结局

In recent years, with the rapid development of the internet, online lending has become increasingly popular. However, along with the convenience it brings, there are also risks associated with this type of borrowing. Many individuals have found themselves in a difficult situation where they are unable to repay their online loans. This article will explore the options and final outcomes for individuals who have accumulated a debt of 360,000 yuan through online lending.

How to deal with a 360,000 yuan online loan that is overdue and unaffordable? When facing such a huge debt, it is important to stay calm and take immediate action to address the situation.

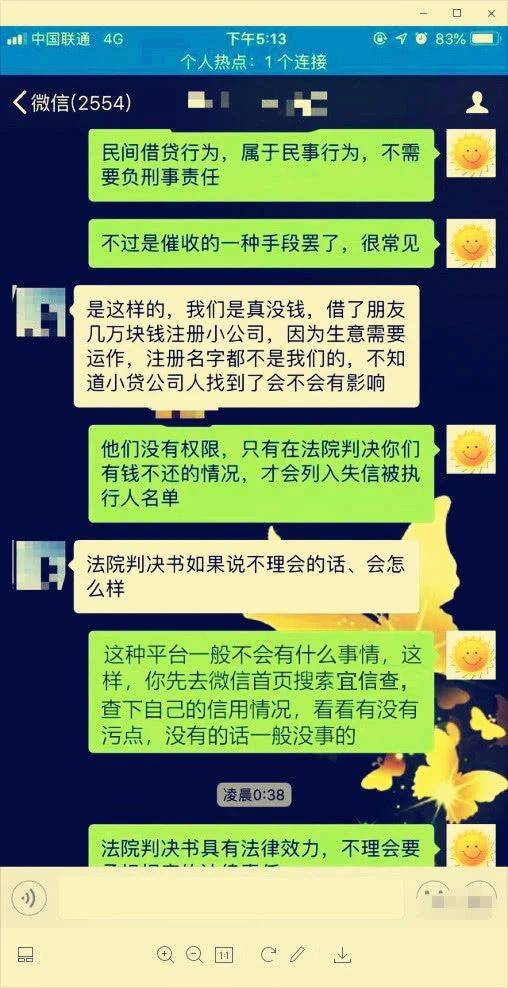

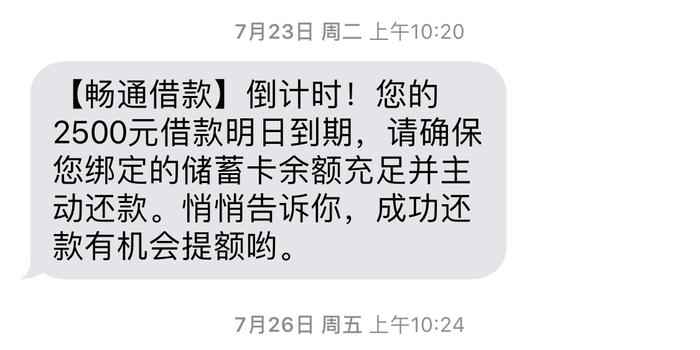

1. Communicate with the lending platform: Contact the online lending platform and explain your financial difficulties. Some platforms may be willing to negotiate new repayment terms or extend the repayment period, allowing you to ease the burden temporarily.

2. Seek professional help: Consulting a financial advisor or credit counselor can provide you with expert guidance and help assess your situation. They may be able to assist in negotiating with the lending platform or develop a repayment plan that suits your financial capabilities.

3. Sell assets or seek loans from friends and family: If you have any valuable assets, such as a car or property, consider selling them to pay off a portion of your debt. Alternatively, you can borrow money from friends or family members who are willing to help.

However, despite these options, if you find yourself unable to repay the entire 360,000 yuan debt, the final outcome may vary depending on the lending platform and your individual circumstances.

1. Debt collection agencies: When borrowers default on their loans, many online lending platforms will transfer the debt to a debt collection agency. These agencies will take various measures to recover the debt, including phone calls, sending letters, and even taking legal action against the debtor.

2. Lawsuits and financial penalties: If the debt remains unpaid, the lending platform or debt collection agency may file a lawsuit against you. If the court rules in their favor, you may be required to pay the full amount owed, plus any associated legal fees. Moreover, your credit score will be negatively affected, making it difficult for you to obtain future loans or credit.

3. Personal bankruptcy: In extreme cases, individuals overwhelmed by debt may consider filing for personal bankruptcy. This should be seen as a last resort since it can have long-lasting consequences on your financial reputation and future borrowing abilities.

When faced with an online loan of 360,000 yuan that is overdue and unaffordable, it is crucial to take immediate action and explore various options to repay the debt. Seeking professional help and communicating with the lending platform are important steps to alleviate the situation. However, if all attempts to repay the debt fail, there may be serious consequences, such as debt collection agencies, lawsuits, financial penalties, and even personal bankruptcy. It is essential to borrow responsibly and fully understand the terms and risks associated with online lending to avoid landing in such a difficult situation.

最新评论

注:以上评论仅作参考,可根据实际情况酌情修改。