年轻人怎么远离网贷逾期

Title: How Young People Can Stay Away from Online Loan Default

Introduction:

With the increasing popularity of online lending platforms, more and more young people are getting involved in borrowing from internet-based lenders. However, the alarming rise in cases of loan defaults among young individuals has become a cause of concern. This article aims to provide practical tips and advice on how young people can avoid falling into the trap of online loan default.

Title 1: How Young People Can Stay Away from Online Loan Default

Online loans have become a convenient financial option for young people due to their easy accessibility and quick roval process. However, to avoid falling into a debt trap, it is crucial for young individuals to understand the importance of responsible borrowing and repayment.

1.1 Borrow within Affordable Limits:

Before lying for an online loan, one must evaluate their financial capabilities and borrow an amount that can be comfortably repaid. Young people should avoid borrowing excessively just because they are eligible for a higher loan amount. Planning a budget and setting realistic repayment goals is essential to prevent loan default.

1.2 Research and Compare Lenders:

It is important for young borrowers to conduct thorough research and compare different lenders before finalizing an online loan. By comparing interest rates, repayment terms, and customer reviews, one can choose a reliable lender with reasonable terms. This reduces the risk of falling into the hands of predatory lenders and being burdened with unreasonable repayment obligations.

1.3 Read Terms and Conditions Carefully:

Young people often overlook the importance of reading the terms and conditions of a loan agreement thoroughly. Understanding the interest rates, late payment penalties, and repayment schedules helps in making informed decisions. Ignorance of the terms and conditions often leads to missed payments and can result in online loan default.

Title 2: How Young People Can Stay away from Online Loan Default

The key to avoiding online loan default lies in maintaining a disciplined roach towards repayment. Here are some strategies to help young individuals stay on track with loan repayment:

2.1 Create a Repayment Plan:

Young borrowers should create a practical and realistic repayment plan based on their income and expenses. Allocating a specific portion of monthly earnings towards loan repayment ensures timely payment and minimizes the risk of default.

2.2 Set Up Automatic Payments:

Setting up automatic payments through online banking or direct debit is a convenient way to ensure timely loan repayments. It eliminates the possibility of forgetting or missing payments, reducing the chances of falling into default.

2.3 Communicate with the Lender:

In case of any financial difficulties or unforeseen circumstances, it is important for young borrowers to communicate promptly with their lenders. Many lenders offer flexible repayment options or temporary payment adjustments for borrowers facing financial hardships. Open communication can help avoid default and establish a mutually beneficial solution.

Title 3: How Young People Can Stay away from Online Loan Default

Apart from responsible borrowing and disciplined repayment, young people can take some preventive measures to avoid online loan default:

3.1 Build an Emergency Fund:

Creating an emergency fund helps young individuals handle unexpected expenses without relying solely on loans. Having a financial safety net reduces the risk of borrowing to meet immediate needs and minimizes the chances of defaulting on existing loans.

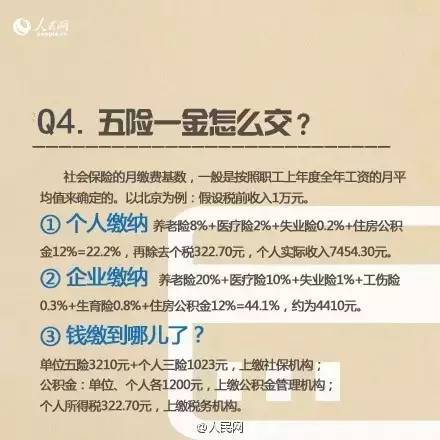

3.2 Seek Financial Education:

Young people should seek opportunities to enhance their financial literacy by attending workshops, seminars, or online courses. Understanding concepts such as interest rates, credit scores, and proper budgeting empowers individuals to make informed financial decisions, decreasing the likelihood of default.

3.3 Seek Alternatives:

Before considering online loans, young individuals should explore alternative sources of funds, such as personal savings, part-time work, or assistance from family and friends. This reduces the dependence on loans and minimizes the risk of defaulting.

Conclusion:

To avoid online loan default, young people should prioritize responsible borrowing, realistic repayment plans, and open communication with lenders. By taking proactive measures and seeking financial education, young individuals can establish a solid foundation for their financial well-being and steer clear of the pitfalls associated with online lending.

最新评论