网贷十三万逾期利息怎么算

Title: Calculation of Overdue Interest for a 130,000 RMB Online Loan

Introduction:

Facing a situation of overdue interest for an online loan amounting to 130,000 RMB, borrowers often find themselves unsure of how the interest is calculated and what steps they can take to resolve the issue. This article aims to provide a comprehensive guide to calculating overdue interest for a 130,000 RMB online loan, and offer solutions for borrowers in such situations.

1. Understanding the Calculation of Overdue Interest

Overdue interest refers to the extra amount charged when borrowers fail to repay the loan on time. Different online lending platforms may have varying methods to calculate the overdue interest. Generally, the formula used is based on the annual percentage rate (APR) and the number of days the loan is overdue.

2. Factors Affecting Overdue Interest Calculation

Several factors can affect the calculation of overdue interest for a 130,000 RMB online loan. These include the loan agreement terms, the interest rate, and the duration of the overdue period. It is crucial for borrowers to familiarize themselves with these factors to understand the financial implications of any delays in repaying the loan.

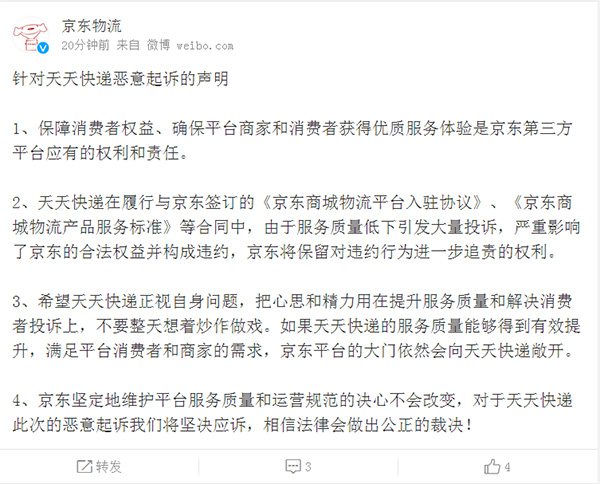

3. Communicating with the Lending Platform

When faced with an overdue loan, borrowers are advised to reach out to the lending platform as soon as possible. Explain the situation honestly and discuss the possibility of negotiation. Some platforms might be willing to offer alternative repayment plans or reduce the overdue interest if borrowers can demonstrate genuine financial difficulties.

4. Exploring Legal Options

If communication with the lending platform fails or is unsatisfactory, borrowers have the option to seek legal assistance. Consulting a lawyer specializing in financial matters can provide guidance on possible legal actions to address the situation. However, it is essential to scrutinize the terms of the loan agreement to understand any legal implications that may arise during this process.

Conclusion:

For borrowers facing the challenge of calculating overdue interest for a 130,000 RMB online loan, understanding the factors that contribute to the calculation is crucial. Communicating openly with the lending platform and considering legal options, if necessary, can help borrowers navigate this difficult situation. It is essential for borrowers to stay proactive, seek professional advice, and explore available solutions to resolve the issue and prevent further financial complications.

精彩评论

最新评论

-

夹谷英飙网贷逾期后,罚息计算通常依据合同约定,不同平台罚息率有所差异,一般在逾期之一天开始每日递增,但罚息率通常不会超过借款本金的1%,逾期时间越长,累计罚息也会越高。