为什么网贷都要还全款呢,怎么办?

Title: Why Do We Have to Repay the Full Amount for Online Loans? What Can We Do About It?

Introduction:

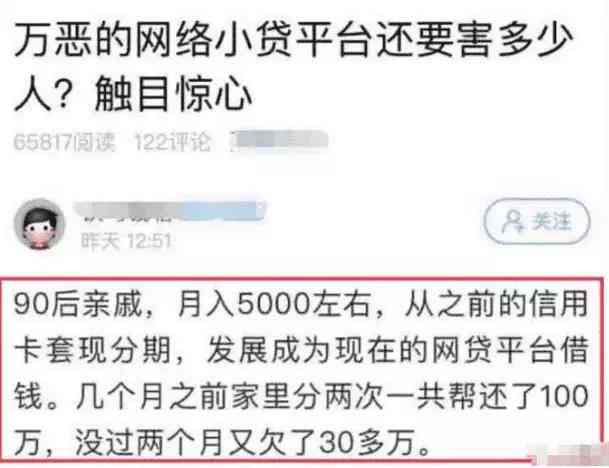

In recent years, online loans, also known as internet loans or peer-to-peer lending, have gained tremendous popularity as a convenient solution to financial needs. They provide quick access to funds without the hassle of complex paperwork or stringent eligibility criteria. However, borrowers often find themselves puzzled about why online loans must be repaid in full and feel overwhelmed by the repayment process. This article aims to explore the reasons behind the requirement for full repayments in online loans and suggest a few strategies to effectively manage and repay these loans.

Why Do Online Loans Have to be Repaid in Full?

Online loans, like traditional loans, require borrowers to repay the full principal amount along with accrued interest. Several factors contribute to the necessity of full repayment:

1. Risk Management: Lenders, whether individuals or institutions, offer online loans with the expectation of receiving the full amount back. By ensuring full repayments, lenders recover their investments and maintain the financial sustainability of their lending operations.

2. Interest Accrual: Online loans involve the accrual of interest over the loan term, which compensates lenders for the risk associated with lending money. Failing to repay the full amount would result in unpaid interest, leading to potential financial losses for lenders.

3. Legal Obligations: Online loans are contractual agreements that are legally binding. Borrowers are obligated to fulfill their repayment commitments as per the agreed-upon terms. Failure to do so can result in legal action and damage to the borrower's creditworthiness.

What Can We Do About It?

1. Assess Repayment Capacity: Before availing an online loan, it is crucial to evaluate one's financial situation and repayment capacity. Consider factors such as monthly income, expenses, and existing debts to determine the maximum amount that can be comfortably repaid.

2. Create a Budget: Develop a comprehensive budget to manage income, expenses, and loan repayments effectively. Avoid unnecessary expenses and prioritize loan repayment to ensure timely and full repayment.

3. Communicate with Lenders: In case of financial difficulties, it is advisable to proactively communicate with the lender. Many lenders are willing to work with borrowers to devise a suitable repayment plan, such as extending the loan term or adjusting monthly installments.

4. Make Timely Repayments: Ensure timely repayments to avoid late payment penalties and negative impacts on credit scores. Setting up automatic transfers or reminders can help in making payments promptly.

5. Seek Professional Advice: If facing significant financial challenges, consider consulting a financial advisor or credit counselor. They can provide guidance on loan repayment strategies and offer assistance in managing debt effectively.

Conclusion:

While online loans may seem daunting due to the obligation of full repayment, understanding the reasons behind this requirement can help borrowers better manage their loans. By evaluating repayment capacity, creating a budget, communicating with lenders, making timely repayments, and seeking professional advice when needed, borrowers can navigate the online loan repayment process successfully.

精彩评论

最新评论

-

濮阳尔槐网贷还款全款确实让人头疼,但不要失去信心,面对这个问题,我们需要理智地分析自己的债务情况,找出问题的根源,尝试制定一份合理的还款计划,一步步实现自己的目标,更重要的是,请不要回避问题,积极地寻求专业帮助或与债权人协商,也许一点点付出就可以告别负债的生活,保持好心态,继续前进吧。