如果碰了那些不用还的网贷,后果会怎样?

Title: The Consequences of Defaulting on Unrepayable Online Loans

Introduction:

In recent years, the popularity of online lending platforms has soared due to their convenience and accessibility. However, there are borrowers who choose to default on loans they deem unrepayable, hoping to escape the financial burden. This article explores the potential consequences one might face if they encounter such unrepayable online loans.

If one comes across an online loan that does not require repayment, it may be tempting to take advantage of this seemingly golden opportunity. However, failing to repay such loans can lead to severe repercussions. The consequences one might face are discussed below:

Financial Difficulties:

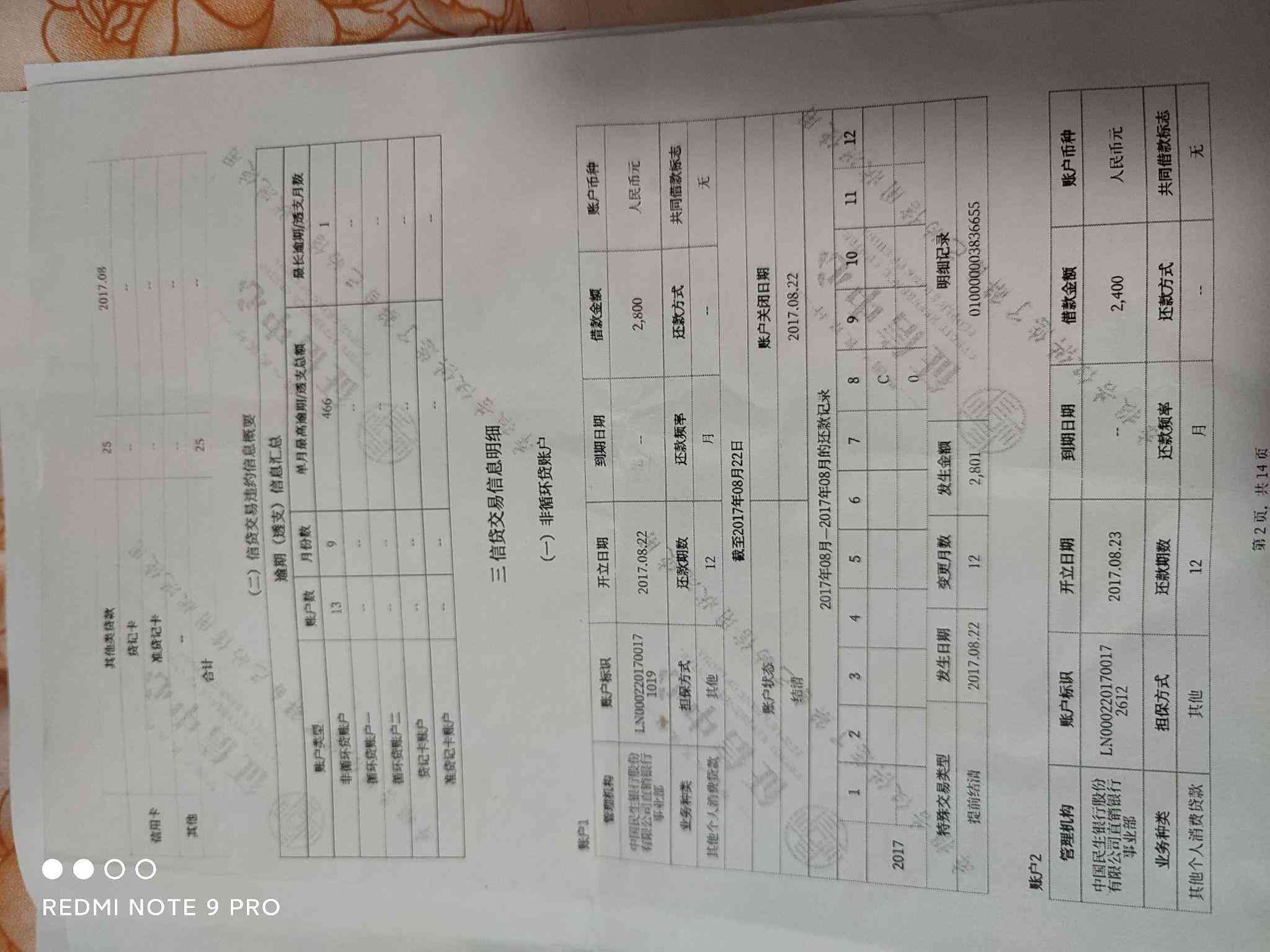

Defaulting on any loan, regardless of its legality, can have dire financial consequences. Unrepayable online loans often come with high-interest rates and penalties, which accumulate over time. The borrower may find themselves tred in a debt cycle, with additional late fees and interest continuously piling up. Such financial difficulties can seriously impact their credit score and overall financial well-being.

Legal Troubles:

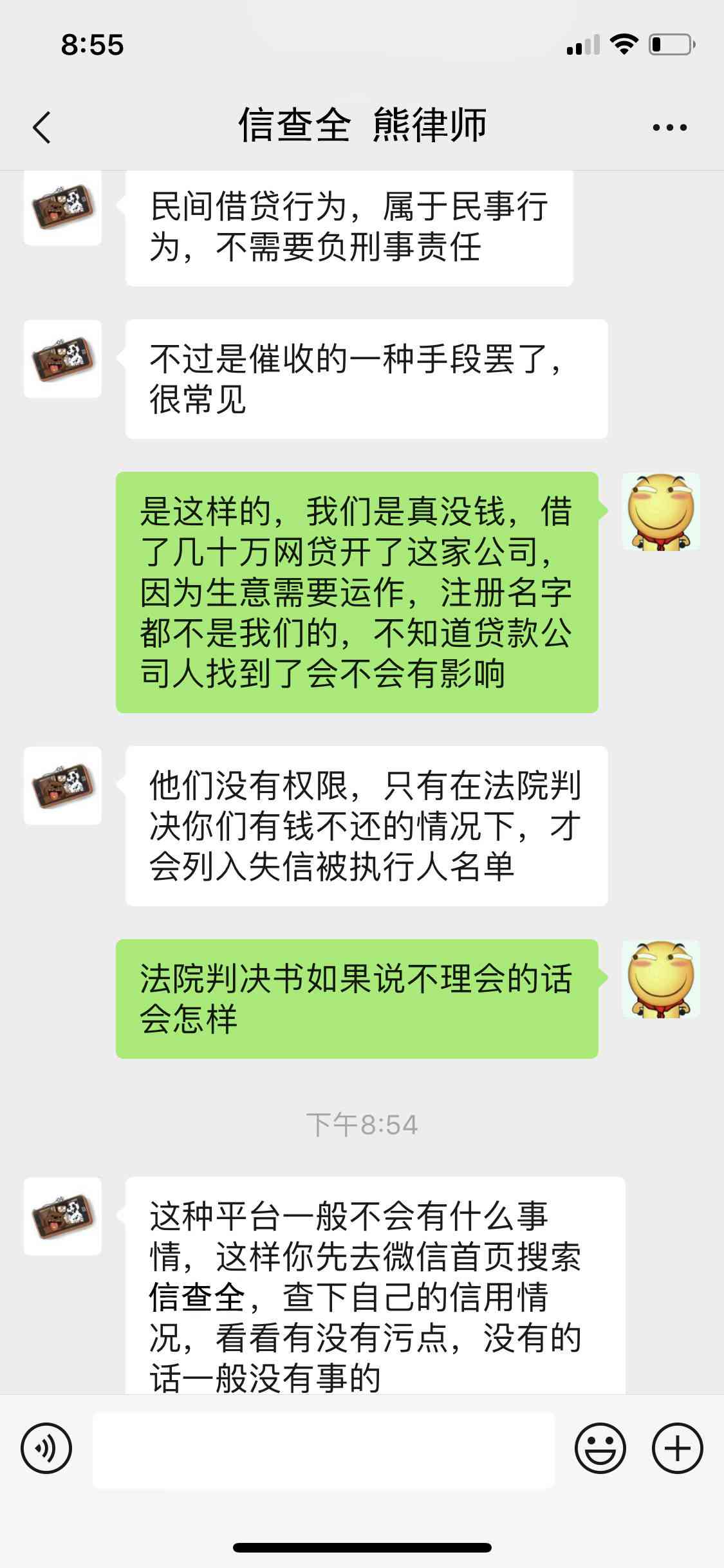

Engaging in fraudulent activities, such as intentionally borrowing without the intention of repaying, can land individuals in legal trouble. Although the legal framework around online lending is still evolving, many jurisdictions consider defaulting on loans as a breach of contract or fraud. This can result in lawsuits, asset seizures, or even criminal charges. It is crucial to remember that borrowing funds without intending to repay is illegal and can have serious legal consequences.

Damaged Reputation:

Defaulting on loans can significantly damage one's reputation. Online lending platforms often share borrowers' information with credit bureaus and other lending institutions. This information may stay on the borrower's credit report for several years, making it difficult for them to secure future loans or financial opportunities. Additionally, sharing personal details with fraudulent lenders can expose borrowers to identity theft or other forms of financial fraud.

Limited Access to Future Credit:

Online lenders employ various methods to ensure borrowers repay their loans. If an individual has a history of defaulting on loans, they are likely to be added to a database known as the \

精彩评论

最新评论

-

暴千风作为人类,要懂得在债务与金钱之间建立合适的界限,当心那些不需要偿还的网贷陷阱,触碰了它们就等于打开了一个个漆黑的无底洞,你可能因此陷入困境,家庭破裂,名誉受损,甚至锒铛入狱,生活并非童话,要明智选择,切勿贪图一时的轻松快乐而付出无法承受的代价,珍惜自己,珍惜家人,远离无底洞般的网贷。